NEFT/RTGS form of the Central Bank of India Download

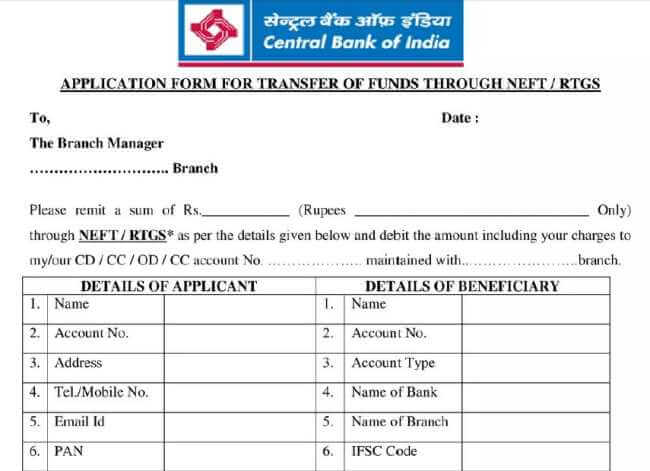

Download the Central Bank of India RTGS/NEFT Form. Central Bank of India is a nationalized bank in India, owned by the Ministry of Finance. To transfer the money directly through any of the branches of the Central Bank of India, you have to submit the RTGS/NEFT application form.

Central Bank of India NEFT/RTGS form PDF

To transfer money between banks, you have to use the RTGS (Real Time Gross Settlement) or NEFT(National Electronic Funds Transfer) option. You can download the RTGS/NEFT transaction form in the PDF format below, take a printout and submit it to the branch so that you can save time.

Download NEFT/RTGS form Central Bank of India

[cs_spacer cs_spacer_height=”30″]How to Fill RTGS/NEFT form of the Central Bank of India

To transfer the money using RTGS/NEFT option, the remitter has to furnish the necessary details.ie; you have to fill in the details of the applicant and the beneficiary.

Details of Applicant includes below details:

- Name

- Account Number

- Address

- Mobile Number

- Email Id

- Pan Card Number

Details of Beneficiary

- Beneficiary Name

- Account Number

- Account Type

- Name of Bank and Branch

- Beneficiary IFSC Code

You can submit the duly filled application form along with the Cheque/Amount to the branch.

For RTGS transaction, there is a minimum amount which is 2 lakh. But there is no maximum limit. But in the case of NEFT transaction through the branch, there is a limit of Rs.50000/-

You can download the Central Bank of India RTGS/NEFT form PDF from the below link.

Download RTGS/NEFT PDF form of the central bank of India

Find below the NEFT Settlement Timing and Service charges of the Central Bank of India

| NEFT SETTLEMENT TIMINGS | NEFT AMOUNT | SERVICE CHARGES |

|---|---|---|

| Hourly batch Settlements under Deferred Net Settlement [DNS] basis from 8.00 AM to 7.00 PM. There are 12 hourly batch Settlements in a day. | Up to Rs.10,000/- Rs.10,000/- & up to Rs.1 lakh Above Rs.1 lakh & up to Rs.2 lakh Above Rs.2 lakh |

Rs.2.50 + GST Rs.5.00 + GST Rs.15.00 + GST Rs.25.00 + GST |

RTGS Transaction Timings

How to fill RTGS form of the central bank of India

To fill the RTGS form of Central Bank of India, you have to enter the Details of Applicant includes: Your Name, Account Number, Address, Mobile Number, Email Id, Pan Card Number etc and the Details of Beneficiary Beneficiary like Beneficiary Name, Account Number, Account Type, Name of Bank, and Branch Beneficiary IFSC Code etc