Bank of Baroda Credit Cards: Features, Benefits, Eligibility & Charges

Find a variety of Bob credit cards, each with its own set of features and perks, as well as charges and eligibility criteria, in the following post. Find out how to apply for a BoB credit card, as well as other related information.

Also Check out how to track the delivery status of your Baroda credit card, how to pay your monthly payments with your BoB credit cards, and more.

Bank of Baroda Credit Cards

Table of Contents

Bank Baroda offers customers various financial services that include cash, check, and credit cards. It provides several card brands offering attractive features and benefits that can be used worldwide by merchants, ATMs, and Online Shopping.

Baroda Bank provides credit cards that are tailored to each individual and offer a wide choice. The card comes with a unique advantage – you get the privilege and promise of savings for every use.

You can earn reward points based on how the card is used. BoB’s card application is straightforward.

Let us examine various Baroda bank card types. Check Pre-approved Credit Cards in just one click.

Add-on card services are available from Bank of Baroda, and the original cardholders credit limit and other benefits are carried over to the additional card.

Bank of Baroda Credit Card Features and Benefits

Similar to many other credit card companies, Bank of Baroda Financial also offers several attractive benefits with its credit cards.

Different credit cards have varying benefits, but there are several benefits to get from most BoB cards:

These may be as a reward point or reward for completing an exclusive membership, gift voucher, or an accelerated cash-back program. The benefit usually becomes available when you have paid a membership fee.

Bank of Baroda Credit Card Rewards Points & Cashback

All BoB Financial cards feature attractive rewards programs. Some cards offer you rewards points or rewards for every purchase.

Other cards offer money-back or miles for the same purchase. Most BoB credit cards offer rewards to customers.

Depending on the category rewards cards can vary in reward levels. A card with a lower annual fee usually offers fewer rewards than a card with higher fees. Rewards for a specific Top Bank of Baroda credit card are shown below:

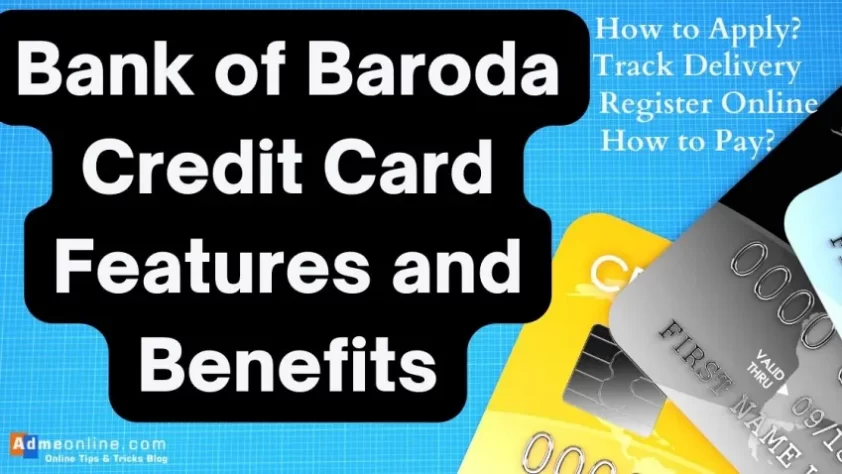

How to apply for BoB Credit Cards

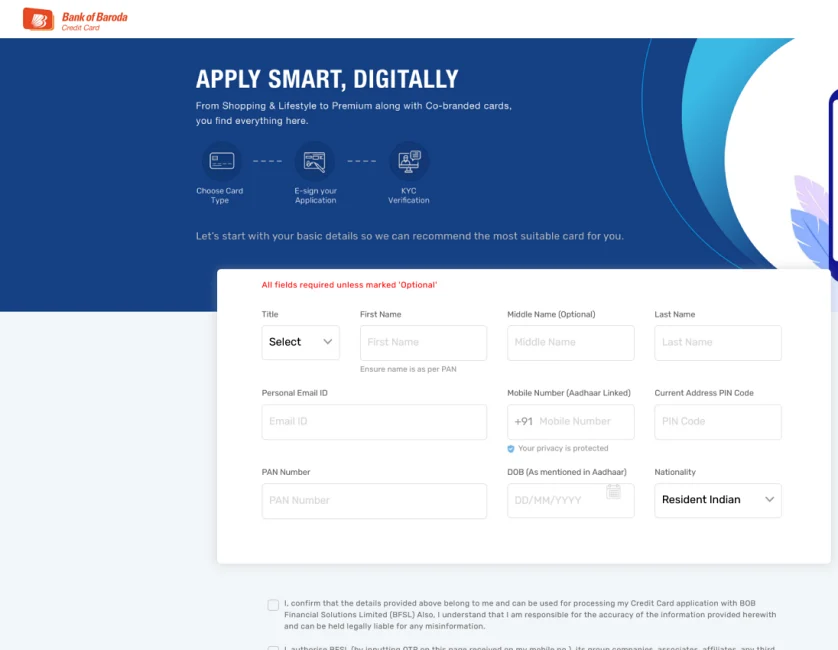

The benefits and features of the Baroda Credit Card are given above. Those who are interested in applying for a credit card, follow the below steps:

- Visit the website https://www.bobfinancial.com/ to submit an application for the Bob credit card online.

- Choose the credit card for which you wish to submit an application.

- Simply select the “Apply Now” option from the menu.

- You are going to be taken to an application form at this time.

Before moving further, be sure that you have carefully filled in all of the essential details and checked them.

Complete all of the required steps in accordance with the instructions provided on the website.

- Go to BOB bank’s official website

- Enter your personal details in the perspective column such as Name, Email id, Date of Birth as mentioned in your Aadhar, Mobile Number, etc.

- Also, enter your Occupation and annual Income, then the system can recommend which BoB card is suitable for you.

- Then tick to the declaration boxes and Click to generate OTP.

- Then move what the page shows and add the details correctly to complete the application.

Why should I use Bank of Baroda credit cards?

Cards from Bank of Baroda include prepaid debit cards in addition to prepaid credit cards.

If a customer has paid for their fuel purchases with a credit card issued by Bank of Baroda, there will be no additional fee assessed.

The card also offers many other attractive benefits like low membership or annual fees, no fees added, insurance, etc.

BoB Credit Card tracking

You can check the Bank of Baroda Credit Card Application Online. If you have internet access, then check easily your credit card application status in a few clicks.

Step 1: Visit the official website dedicated to cards maintained by Bank of Baroda in order to track the Application. The page may be found at https://www.bobfinancial.com/track-application-status.jsp

Step 2: After applying for a Baroda Credit Card, you should have received an application number via the Mobile Number or Email Address that you provided in your application.

Step 3: After entering the Application Number, click the ‘Get Details’ button to continue..

Step 4: Now, you can see the status of your credit card on the screen.

If you don’t have Internet access, you can check the status of your credit card application offline.

This is the BOB customer care helpline number 1800 258 4455 / 1800 102 4455 to contact to know the status of your credit card application. The helpline is available Monday – Friday, except on Saturdays, Sundays, and other public holidays.

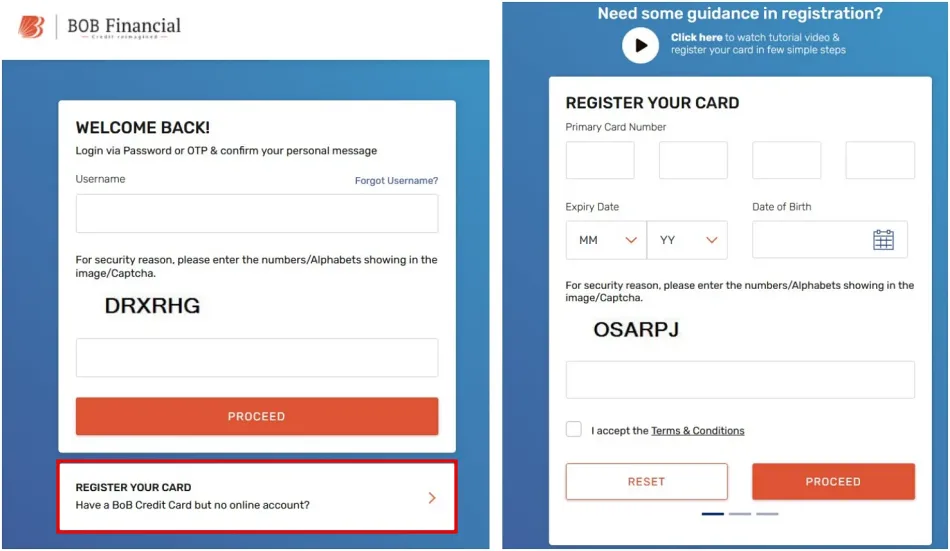

BoB Credit Cards Login / Netbanking

Nowadays most banks offer internet banking to their customers. Alternatively, you are able to benefit from this good service if you use Bank of Baroda Credit Cards for Internet Banking.

1: Firstly, you need to visit BoB Cards official website here: https://online.bobcards.com

2: Scroll down and find the Registration link

3: Enter all of your required information such as your credit card number, Expiry Date, Date of Birth etc.

4: Enter the Captcha shown on the screen and accept the Terms

5: Click on ‘Proceed’ button

6: Now you will get an OTP on your registered Mobile Number

7. After verifying the OTP, you will get an option to create your User ID and Password.

Once the Credit Card Online registration is completed, you can enter Login credentials and Captcha to manage your Card.

After the login you can manage your credit limit, Spend limits etc.

Best BoB credit cards in India 2022

Bank Baroda provides various credit cards with different functions and several types. List some of the most popular and prestigious BOB Credit Card features in the following

Bank of Baroda was created in 1906 and is renowned for its banking services. The Bank is the largest bank in the country and provides banking solutions to all the people around the world.

It is headquartered in Vadodhara, Gujarat and runs more than 5000 branch offices. Since April 1, 2019, Vijaya Bank and Dena Bank have been amalgamated into Bank of Baroda.

1. Bank of Baroda Select Credit Card

Bank of Baroda Select Credit Card is one of the most popular credit cards offered by BoB Financial. Select Credit Card has exciting rewards offers and many benefits.

It earns you reward points for all your spending, plus extra reward points for your spending on other online purchases (You will get extra Reward Points for your spending on dining, utility bills, and online purchases). The card has many other advantages, which are mentioned below:

- 24*7 support services.

- Major purchases can be paid as EMIs

- Chance to earn bonus reward points worth Rs.1,000 every month.

- 1% fuel surcharge.

- The reward points you get can be redeemed for points, cashback, and various other

- Cost-based joining/renewal fee waiver.

- Accidental death insurance coverage

- You will not become the owner of any fraudulent transactions made on the lost/stolen card after the credit card has been reported lost.

2.Bank of Baroda ETERNA Credit Card

Bank of Baroda Eterna is a premium credit card that offers many exclusive benefits. Like unlimited domestic lounge access, a foreign exchange mark-up fee of 2%, and insurance cover up to Rs. 1 crore are some of the key features of this card.

More details of the Bank of Baroda Eterna Credit Card are given below:

- 1 15,000 worth Rs Welcome gift of Fit Pass Pro membership

- Earn up to 15 reward points on travel, international spending, dining, and online shopping.

- Unlimited domestic launch access

- 2% Foreign Exchange Mark-up Fee .

- Buy 1 Get 1 Free Movie Tickets through Paytm

- Up to 20,000 Bonus Rewards, Points are granted as 6 milestones spend benefits

- Personal accidental death insurance. 1 crore

3. Bank of Baroda Premier Credit Card

Baroda Premier Credit Card offers special rewards programs and benefits across several categories. With this card, you will get 2 reward points for every Rs. 100 you spend, you can earn extra reward points for dining and travel. Some more benefits are listed below:

- Welcome benefit: get 2,000 reward point

- Complimentary lounge access at 4 domestic airports

- The surcharge can be earned on fuel transactions worth Rs. 500 to 4,000 rupees at all petrol pumps in the country. Maximum discount of Rs.250 per month.

- Spent Rs. 100 for all purchases, earn 2 Reward Points for every

- Maximum reward earning is limited to 2,000 points. To accelerate your reward earning by 10x when using the card for international spending, online travel aggregators, and dining.

- Redeem your rewards against gift vouchers and merchandise.

- Convert your purchases worth Rs. 2,500 or more towards easy EMIs of 6-12 months.

4. Bank of Baroda Prime Credit Card

Bank of Baroda Prime Credit Card offers many features and benefits. The main advantage of applying for the Prime credit card is that if you are a customer of Bank of Baroda, you will be assured of issuance of Rs 15,000 or more without showing any income proof.

Some of the other features of the Bank of Baroda Prime Credit Card are listed below :

- Bank of Baroda customers can get the issue of a guarantee against a fixed deposit of Rs.15,000 or above without producing any income proof.

- Get 4 reward points for every Rs 100 you spend or Rs 1 on redemption.

- You don’t need to pay a joining or annual fee for the first year

- If you buy fuel worth between Rs 400 and Rs 5,000, the maximum discount you can get is Rs 250.

- provides multiple options to redeem your reward points as cashback.

- On any transaction of Rs 2,500 or above, you will have the option to repay the amount through EMIs between 6 months and 1 year.

5. Bank of Baroda Easy Credit Card

Bank of Baroda Easy Credit Card is unique compared with other credit cards, because it is the only credit card offered by Bank of Baroda that is suitable for low-income earners and offers accelerated rewards and cashback offers for common spending categories.

Plus, the card gives you rewards points for all your spending, and you can earn extra rewards points when you spend at department stores, groceries, and movies.

Along with this, the card has many benefits, some of the features are given below:

- The card offers 0.5% cashback on bill payments.

- You can redeem your reward points against cashback and various other products and categories.

- Exemption of cost-based joining/renewal fees

- 24*7 Help Desk.

- If you are making a big purchase and don’t need to pay cash immediately, you can convert the amount into EMI.

- A Waiver of 1% fuel surcharge.

- If you lost/stolen your card. after reporting that, get zero liability protection against the lost card.

6. HPCL BoB ENERGIE Credit Card

This card is aimed at those who spend frequently on fuel and want to save on their spending. A very nominal Rs.100. 499, the Energy Credit Card offers a host of exclusive benefits across various categories.

Some of its great qualities are as follows:

- Welcome benefit: 2000 bonus reward points

- Earn up to 24 reward points for every Rs.150 spent.

- complimentary domestic lounge access may be obtained

- Offers 25% discount on movie ticket bookings on BookMyShow

- Waiver of 5.1% fuel surcharge on all fuel transactions.

7. IRCTC BoB RuPay Credit Card

Railway Ticket booking offers very good reward rates. Apart from this, IRCTC BoB RuPay Card has many other benefits given below :

- Welcome benefit: 1,000 bonus Reward Points

- For every spend of Rs. 100 get Up to 40 Reward Points

- 4 complimentary domestic lounge access to get

- The credit cardholders get a save 1% fuel surcharge waiver and railway surcharge waiver.

8. Bank of Baroda Assure Credit Card

You can get the BOB Assure Credit Card for a yearly charge of Rs.500, and if you ever find yourself in a crisis, you can take cash from your available credit line.

Features and Benefits:

The joining fee is ZERO,

The annual charge is Rs. 500.

You can get a credit card against your fixed deposit without providing any proof of income.

In the event of an unexpected emergency, you are permitted to withdraw up to the full amount of your credit limit in cash.

Zero fuel surcharge.

There are no annual fees based on usage of the card.

Bank of Baroda Credit Cards Eligibility Criteria

Nearly all credit card issues must meet certain eligibility conditions to obtain a credit card. The eligibility requirements for BoB’s financial credit card are dependent on age, income, credit scores, etc.

- The age of the applicant is one of the eligibility, Eterna Credit Card the user should have to be between 21 years to 65 years, and all other cards eligibility between 18 years to 65 years

- Applicants must have a steady source of income.

- Applicant must have a decent credit score.

Documents Required For Bank Of Baroda Credit Card Application

Applicants should upload and submit a couple more pieces of documentation such as identification and address proofs during the Bank of Baroda credit card application process.

1. Identity Proof :You can submit any of the below documents as the Identity proof for the bob credit cards application.

- PAN Card,

- Aadhar Card,

- Voter ID,

- Passport,

- Driving Licence

2. Address Proof: As evidence of your address, you can submit any one of the following documents:

- Aadhaar Card,

- Voter ID,

- Passport,

- Driving license,

- Lease Agreement,

- Utility bills,

- House allotment letter issued by central and state governments,

- Municipal or property tax receipt

3. Income Proof: Along with the application for the credit card, you are required to show documentation that you have a stable income.

- For salaried employees – last two months’ pay slip and bank statement showing salary credits.

- For Self Employed Individuals – Later ITR (Income Tax Return).

Payment of BOB credit card - How to Pay Bank Of Baroda Credit Card Bill

Customers of Bank Of Baroda have a number of different choices available to them when it comes time to bob credit card bill payment.

Cash payments are accepted: If you need to pay your credit card bill, you can do it at any of the Bank of Baroda branches.

Place a check drawn in favour of “Bobcard No.,” where “Bobcard No.” is replaced with your 16-digit card number, at any branch of the Bank of Baroda.

Find below bob credit card online payment Options:

Insta Pay Service:

You can make an instant payment on your credit card bill through the Net Banking Self-service Portal: Sign in to BoB Internet Banking portal and complete your transaction there.

Bill Desk:

Make your payments at the bill desk.

NEFT/RTGS:

When making a payment through NEFT, you are asked to use the IFSC Code BARB0COLABA and your 16-digit credit card number as the Beneficiary account No (Kindly mention name and registered mobile number in remark column).

Auto Debit:

Customers who have accounts at Bank of Baroda have access to the auto-debit feature (click to download the form and forward it to us through the Bank of Baroda branch)

Razor Pay:

Razor Pay is a personalized payment link solution that is enabled by Razor pay to aid you in making a safe and hassle-free online payment of your bills.

What is cash limit in credit card BoB?

In general, the cash withdrawal limits that are offered through the Bank of Baroda Credit Cards are set at a percentage that is equal to fifty percent of the credit limits. Many people who use credit cards have the misunderstanding that their full credit limit is the amount of cash advance funds that is available on their account.

Join Our Facebook Group : www.facebook.com/groups/admeonline

Subscribe Our YouTube Channel: Youtube.com/admeonline

Also Read

- Bank of Baroda ATM Pin Generation

- Bank of Baroda Balance check Number

- Bank of Baroda Helpline Number

- Bank of Baroda KYC Form

- Bank Holidays in India

Related Post

Resetting Your SBI YONO Login Password:...

Please ShareIf you’ve forgotten your SBI YONO login password, don’t worry! You can easily reset it using the following steps How...

SBI ATM Card Replacement Process: A...

Please ShareThe State Bank of India (SBI) is one of the largest banks in India, with over 24,000 branches and ATMs across the country. If yo...

Reporting Unauthorized Transactions in Your SBI...

Please ShareLast updated on November 17th, 2023 at 05:14 am In an age of digital transactions, safeguarding your financial assets is paramou...