How to add Intra-Bank, Inter-Bank Beneficiary in OnlineSBI

Learn with Step by step-by-step instructions, How to add beneficiary in Online SBI. You can transfer money to your own personal account in the same bank, to the account of someone else within your bank, and even to someone else account in another bank. All you need is an internet connection.

You can transfer money to any account via online. To transfer money to another account, you have to add and approve the beneficiary (One Time). Once the beneficiary is approved by the bank, you can transfer the money at any time. In this tutorial, we learn how to add a beneficiary in SBI to transfer funds.

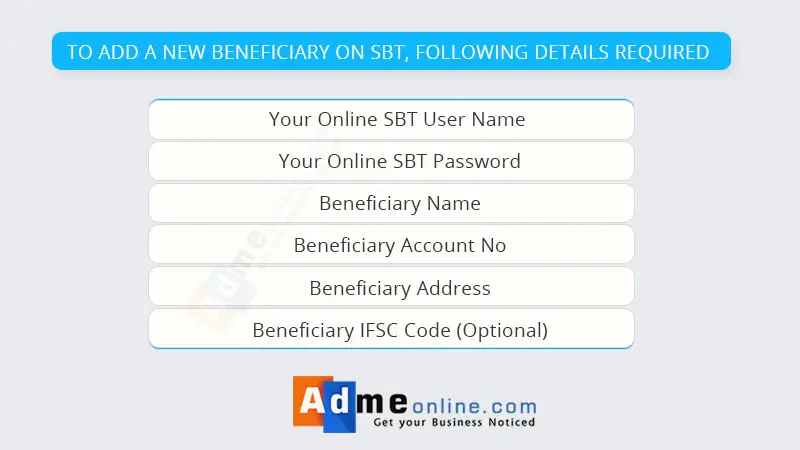

What are the details Required to Add and Approve Beneficiary in SBIOnline

Step 1 : Log on to Online SBI by using your Internet Banking ID and Password.

You can add a ‘Intra-Bank Beneficiary‘ (with SBI Account) or ‘Inter Bank Beneficiary‘ (With Other Bank Account)

Watch the Video Tutorial Here (Same Procedure for Adding Beneficiary in SBI ) :

How to Add an Intra-Bank Beneficiary in Online SBI (To Transfer Money from SBI to SBI Online)

Step 2 : Click on the ‘Manage Beneficiary‘ link in the ‘Profile‘ tab. You have to login with your SBI profile password.Then click ‘Manage Intra-Bank Beneficiary‘

Step3 : Enter the Beneficiary SBI Account No and Transfer Limit and then click submit. Once the Intra-bank beneficiary is added successfully, you will get an SMS alert in your registered Mobile no.

Please note that only one beneficiary can be added in a day. You can approve the beneficiary in the same session.

How to Add an Inter-Bank Beneficiary in SBI (To Transfer Money from SBI to Other Bank Accounts)

Step 1 : To add an Inter-Bank Beneficiary (Other Account No), Click on the ‘Manage Beneficiary‘ link in the ‘Profile‘ tab, login with your SBI profile password.

Then click ‘Manage Inter-Bank Beneficiary‘.

Step 2 : Enter the beneficiary Account No (Other Bank account), Address, Transfer Limit etc

Step 3 : Select & enter the ‘IFSC Code‘ option if you know the Beneficiary bank IFSC Code, otherwise select the ‘Location‘ option and then select the beneficiary Bank name, State, Branch etc

Step 4: Select (Tick) the Terms & Conditions & Submit. You will get an SMS alert in your registered Mobile No.

You can approve the beneficiary in the same session by clicking the ‘Approve Now’ button.

How to Approve the Beneficiary in SBI

Step 1: To approve an Intra-Bank (Beneficiary with SBI Bank Account) or Inter Bank (Beneficiary with different Bank Account),

Login to your Profile and Click on ‘Manage Beneficiary‘

Step 2: To Approve an Intra-Bank Beneficiary in SBI, click on ‘Manage Beneficiary‘ and then ‘Intra-Bank Beneficiary‘

link. Click the ‘Approve‘ tab. Follow the same steps to approve an Interbank Beneficiary.

Step 3 : Select the Approval Type (You can approve a beneficiary through ATM or OTP (One Time Password)

If you select the OTP approval method, you will get an SMS with the OTP in your registered Mobile No.

Step 4 : Select the ‘Approval pending Beneficiary‘ name & enter the High Security Password (OTP) received in your Mobile and click ‘Approve‘.

If you have not received the OTP , Click the button with the caption ‘Click here to resend the SMS‘.

Normally bank will activate the beneficiary within 4 hours if you have added the beneficiary in normal business hours. Otherwise, the beneficiary will be activated in the next working day.

Beneficiary approval is a one-time process. You can transfer money to an approved beneficiary at any time.

If you like this post, please share it with your friends in Facebook.

Related Posts:

- SBI/SBT ATM Pin Generation through SMS, SBI Green Pin process

- How to Block SBI/SBT ATM Card Online

- How to get Bank account Balance Information Through Missed Call