In this blog post, Learn the difference between a credit card and a debit card. Do you think credit cards differ from debit cards? I can understand the reason for that. Various locations accept debit and credit cards.

The two products are convenient but eliminate the need to carry cash. It looks very much the same. What makes credit cards differ from debit cards is how the credit cards collect the funds.

The difference between Credit Cards and Debit Cards

Discover the key distinctions between a debit card and a credit card. When it comes to making purchases, different types of plastic cards have varying degrees of success.

Debit and credit cards offer convenient ways to pay without cash or checks, and they are accepted in nearly all the same places. But that’s where the similarities end.

The fundamental differences are where the money comes from, and what it can cost. Debit cards typically pull funds from a checking account.

When you purchase with a debit card, money is taken out of the account you already have. When we pay for the transactions using a credit card, the money in our checking account (bank) will not be affected, and instead, we will be using the funding provided by the credit card company.

Credit cards are frequently cited as the most cost-effective alternative to cash transactions.

They become the best way to manage money thanks to the cash rewards and the variety of safety features that they offer. There are some fundamental differences between debit cards and credit cards despite the fact that they appear to be the same.

Debit and credit cards are used to pay for goods or services without cash or check. The origin of the funds used to make the purchase is the defining characteristic that differentiates the two.

If you purchase with your debit card, the money necessary to cover the cost of that purchase will be taken out of your checking account (Debit Card linked bank account) almost immediately.

If you pay with a credit card, the amount will be deducted from the total available on your credit line. That you will pay the borrowed amount (bill) at a later date, giving you additional time to make payments in the future.

Debit cards vs. Credit cards

Because there is a limit placed on the amount of money that can be spent with a debit card, the use of a debit card for financial transactions is restricted.

When you use a debit card, the maximum amount of money you can spend is determined by the amount of cash that is currently available in your account.

Because using credit cards does not reduce the amount of money you have in your bank account, you are able to spend more money (up to the Credit Limit) than you would normally be able to.

Paying with a debit card offers a great deal of convenience. They are simple to use and do not impose any additional fees or interest on the purchases that are made.

Using credit cards, which are a great option for managing the amount, can make it easier to keep track of the amount in your account as well as make it simpler to pay off debt in a timely manner. Both of these tasks can be made simpler by using credit cards.

To phrase it another way, particular credit cards offer an increased level of protection for purchases, which can be helpful when attempting to get the price of an item refunded.

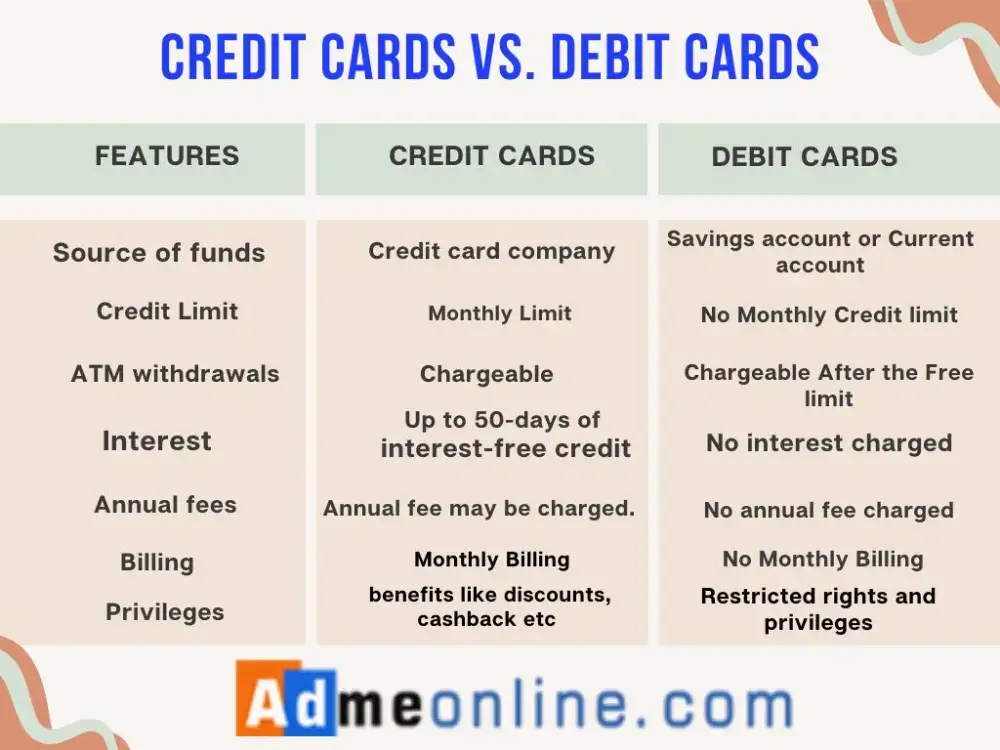

| Features | Credit Card | Debit Card |

| Source of funds | Funding provided by the Credit card company | Using money in a bank savings account or Current account |

| Credit Limit | Maintains a consistent credit limit each month | No Monthly Credit limit |

| Usage | Can be used at all stores and on the web | Some websites may not be able to use it. |

| ATM withdrawals | Chargeable | Not chargeable up to the monthly Free limit. After the Free limit, there will be a charge. |

| Interest | Up to 50-days of interest-free credit | No interest charged |

| Annual fees | Annual fee may be charged. | No annual fee charged |

| Eligibility criteria | The ability to get a credit card depends on many things, such as salary, credit history, where you live, etc. | In order to obtain a debit card, all you need is a bank account. |

| Security features | Protection against fraudulent activity and insurance | No zero-liability insurance |

| Billing | Compiles all transactions in a billing cycle and prepares a final bill to be paid within a certain time. | Direct spending from your account means no bill. |

| Privileges | Includes benefits like discounts, cashback, and other perks | Restricted rights and privileges |

What is Credit Limit?

The spending limit on your card is the maximum amount of money that you are authorized to spend using that card at any given time.

Your monthly spending limit is a number that is determined by the card issuer.

You should never go over the limit that has been established, and you should make it a goal to use no more than thirty percent of the total credit limit that is available to you.

Your credit history, which includes the amount of money you spend on your card and how you have historically repaid that debt, will have an impact on your credit score.

What is Credit Score?

If you don’t pay off your outstanding amount in full every month, the credit card company will charge you an interest fee equal to a certain percentage of the balance.

Paying off as much as you can each month is a useful piece of advice for improving your credit score and avoiding credit card debt.

The utilization of credit cards contributes to the formation of credit history. Your credit history will grow to the extent that you have used your card to make purchases and that you have paid off those purchases on time.

When you want to buy a house, a car, or anything else that requires financing, having a solid credit history is essential. Your ability to pay will be demonstrated if you can settle the balance on your card each month.

What is a debit card?

Debit cards are extremely common, but many people aren’t aware of the benefits and drawbacks associated with using them. Debit cards are financial products that resemble credit cards but can be used in the same manner as cash or personal checks.

A payment card known as a debit card is one that takes money directly from an individual’s bank account rather than taking out a loan from the bank.

Customers of major payment processors like Visa and MasterCard have the ability to access their money whenever they need it with the help of debit cards, which provide the same level of convenience and protection as credit cards.

It is possible to have two types of cards in addition to an alternative type of card for customers, and this does not require customers to have a checking or savings account.

There are two primary modes of operation for debit cards:

1. A card that allows you to immediately withdraw money from an ATM.

2. Similar to a check when you are purchasing an item.

Advantages of a Debit Card.

1. It is simple to obtain: When you open an account with most banking firms, you will be given a debit card upon request.

2. Convenience: Instead of filling out a paper check, purchases can be made using a contactless payment method, a card, or by swiping the card instead of using cash.

3. Safety: You won’t need to carry around cash or a checkbook when you use this service.

4. Widely Accepted: Debit cards can be used almost anywhere outside of the city (or even outside of the country) (be sure to tell your financial institution that you are leaving your city to avoid service interruptions).

Disadvantages of a Debit Card

There are a few drawbacks to using a debit card.

1. There is no grace period because your checking account is the source of the funds that are used by the debit card.

You are able to borrow money on credit using the money that you have available in your account when you use a credit card.

2. Balancing Your Checkbook If not every debit card transaction is recorded, it may be difficult to balance your checkbook and keep your account in the black.

3. The possibility of fraud: The majority of banks and other financial institutions work hard to protect their clients from debit card fraud. However, a consumer could be held responsible for some of the costs associated with fraudulent debit card transactions.

Be sure to verify the information with your bank or other financial institution.

4. Transaction fees: It is possible that using your debit card to conduct transactions at an ATM that is not affiliated with your financial institution will result in transaction fees.

What is a credit card?

A credit card account carries funds that can be borrowed by the card.

The cardholder agrees to return the cash, along with interest if it is required, upon being asked to do so.

It is possible for credit cards to provide discounts on travel credit cards in addition to other benefits that debit card holders who participate in reward programs are not eligible for. You can choose between a flat reward or a tiered one.

A credit card is a useful form of payment that can be put to use for a variety of different kinds of purchases, including grocery items and other kinds of goods and services.

It is also a great source for purchasing large-ticket items such as televisions, travel packages, and jewellery, which you may not always have the funds for.

This is because it is possible that you may not always have the funds for these items. Therefore, having a credit card is very convenient.

Advantages of a Credit Card

The benefits of having a credit card.

- Short Term Loan: It is much simpler to conceal and transport a credit card than cash, and it is also much simpler to keep track of a credit card than the exact amount of money that you have.

When you use a credit card, you don’t have to worry about whether or not you have enough cash on hand to pay for expensive purchases.

- Reward Points: Many credit cards come with rewards that can be redeemed for cash back, hotel points, airline miles, or even a rebate on gas purchases.

These rewards can be used to subsidies the cost of the purchase or traded in for one-of-a-kind facilities. There are some reward cards that provide access to various discounts and other benefits.

3. Pay over time : Make purchases now and pay for them at a later date with the ability to pay for them with a credit card.

In addition, the introductory annual percentage rates (APRs) on many credit cards are set at zero percent.

If you make a large purchase with one of these cards and pay off the balance before the standard interest rate takes effect, you could end up saving a significant amount of money on interest charges.

4. Balance transfers: If you use a credit card that charges you no interest on balance transfers, you can significantly cut the cost of what you owe, which will help you get out of debt more quickly.

It does not necessarily have to be a debt incurred on credit cards.

There are some credit card companies that will let you transfer balances from other kinds of loans to their cards.

5. Easy Credit Card Bill Payments: Most credit card companies offer customers convenient payment methods, making it easy to settle any balance. You can pay your credit card bill using the card company’s app or online banking account even if you don’t have a checking account with the bank that issued your card.

Disadvantages of a Credit Card

1. Excess cost and debt: When people use a credit card, they frequently spend more money than they currently possess, which can lead to financial difficulties. This is especially true in the event that the payments do not show up, that they do not actually feel, and that we do not have to deal with the bill for several weeks.

2. High-interest rates: The annual fees charged by credit card companies are exceptionally high in comparison to those charged by other lenders.

3. Fraudulent things: You can rest assured that you will not be held financially responsible for any unauthorized transactions that are conducted using your account. But defending oneself against the accusations is difficult. If you are unable to make your payments as a result of the fraudulent activity, this can temporarily hurt your credit report.

4. Short-term credit hit: Whenever you open a new account for a credit card, your credit score may take a potential hit that lasts for several months.

5. Late payment fees: In the event that you are late in paying your credit card bill (not paid it on the due date), the company that issued your card will assess a late payment fee.

How do you choose which card to use (Debit Cards or Credit Cards)?

When deciding whether to use a debit card or a credit card, it is essential for us to be trustworthy in the way that we manage our financial dealings, including both credit and debit card transactions.

It is in your best interest to use a credit card as soon as possible when spending problems arise so that you can avoid accumulating debt. Choosing the right card also takes into account your spending habits.

Several car and hotel rental companies prohibit debt payments. For bookings to be accepted, for instance, non-airport destinations might require utility bills or check stubs as proof of payment before approving the reservation.

It’s likely that using credit cards will make your life a little bit easier.

When you make a purchase with a debit card, the money is taken directly from the debit account that you have set up on your bank account.

The money on credit cards is billed into your account so you can pay it later, and it also provides you with the opportunity to pay.

Sometimes it’s difficult to determine which cards to use. If you want to make a quick cash purchase every day, use a debit card.

You could use the cards you used for large things like rentals and hotel rooms. You could also use them so you can pay back your bill when you need to.

Credit Cards vs. Debit Cards: An Overview

The numbers, expiration dates, magnetic stripes, and EMV chips on credit cards and debit cards typically consist of the same 16 digits.

Both of these options are very useful when it comes to efficiently carry out financial transactions and shopping online.

Credit cards are commonly used for making payments, whether it be for purchases or cash withdrawals from a retailer. The majority of us carry either a credit card or a debit card with us at all times.

Although the major differences are substantial and may have a sizeable impact on your financial situation in the long run, the convenience and safety features offered by this option are difficult to outdo in any way.

Is it better to use a credit card or a debit card?

Credit card users are required to pay their balances monthly in a timely manner. I would advise using a credit card as much as a debit card to pay off the balance and take full advantage of credit card rewards programs and buyer security. You can buy anything with a credit card and pay a monthly tax. It doesn’t restrict shopping. Banks issue debit cards. Normal debit cards can only be used at ATMs. Credit is safer because: 1. When you use a debit card, money leaves your account and is harder to get back. Credit card payments are monthly. Dispute a problem first. 2. Credit card issuers, especially American Express, improve customer service. You can ask for a refund if you can prove the merchant didn’t deliver what you ordered. Credit cards offer more rewards. You’ll get cash back and miles. You’ll earn up to 7% on your spending.

Is an ATM card a credit card?

The ATM card isn’t a credit card. The bank card. ATMs are plastic card types and payment cards with magnetic strips and/or a plastic smart card that contains a unique card code and a number that can be used to store certain security items.

For more updates, Follow us on Facebook and YouTube.

Related Posts:

- NACH Full form in banking

- What is NEFT Form in Bank

- How to Block SBI ATM Card Online

- How to get Bank account Balance Information Through Missed Call

- How to Open a Post Office Savings Account