can i transfer money from credit card to bankcan transfer money from credit card to bank accountcan we transfer money from credit cardhow to send money from credit cardhow to transfer money from credit cardhow transfer money from credit card to bank accountways to transfer money from credit card to bank account

You can easily transfer money from a credit card to a bank account. The credit card is issued by the bank to those customers who maintain a good relationship with the bank, after checking the CIBIL score, IT returns, etc.

You can use the fund available on your credit card for emergency usage by transferring those funds to your bank account, where direct credit card payment is not possible.

Credit cards are typically used to pay for services, and they are not the primary method of depositing funds into savings or current accounts. However, they are one of the methods of obtaining funds in an emergency or to meet one’s financial obligations.

For example; If you want to pay a Home loan/Car loan, or other Credit card bill through the bank account, where direct payment through the credit card is not possible.

In such a situation, the easiest method is to utilize the funds available on your credit card and transfer those funds to your bank account.

The advantage of utilizing a credit card balance is that you can convert the credit card amount to EMIs of low-interest rates.

Find below How to transfer money from a credit card to a bank account Online

How to transfer money from a Credit Card

Reserve Bank of India allows you to transfer money from a Credit Card to a Bank account only through ATM and Net Banking. When you directly withdraw money from an ATM using a Credit Card, they will add a huge transaction charge on your next credit card bill for the withdrawal. Also, your Credit score will be affected.

There are several Mobile Apps available in the Google Play Store and App Store, which help you to easily transfer money from a Credit card to a Bank account.

App to transfer money from Credit card to bank account:

By using Mobile Apps like PayTM, MobiKwik, PayZapp, etc you can easily transfer funds to your bank account by using their wallet facility.

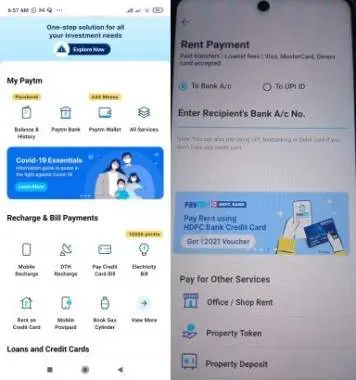

How to transfer money from a Credit Card to a PayTm account

You can top up your PayTm wallet through a Credit card and then transfer the wallet balance to a bank account. But this is not Free. Paytm will charge a 2.5% transaction charge for adding money to the wallet through Credit Card.

But you can use the Paytm ‘Rent Payment‘ option to transfer the money from your Credit Card to the bank account with only a 2% transaction charge.

Follow the below steps:

Step 1: Open the Paytm App on your Mobile and go to the ‘Recharge & Bill Payments ‘ section.

Step 2: Then tap the ‘Rent on Credit Card‘ option

Step 3: tap ‘Enter Recipient’s Bank A/c No’ and fill in Bank account number, IFSC Code, Account holder name, etc, and tap ‘Proceed‘.

Note: Make sure that the Bank account details you entered here are different from the bank account you linked with your Paytm account.

Step 4: On the Payment page, now you can select the credit card. Enter the Credit card details and complete the transaction.

By using this method, you can transfer the credit card fund to your bank account with only a 2% transaction fee.

How to transfer money from Credit Cards of any bank using Mobikwik account

You can transfer the money from your Credit cards of any bank to the bank account through the Mobikwik App.

Follow the below steps:

Step 1: Download the Mobikwik App from Google Play Store

Step 2: Go to ‘Wallet to Bank Transfer’ and Tap the ‘Transfer now’ button.

Step 3: Now enter the Beneficiary Account Number IFSC code etc or UPI ID

Step 4: Enter the Amount to transfer and then select the Payment Mode

Step 5: Enter your Credit Card details and Complete the Payment.

The amount transferred will be reflected in the bank account instantly.

Online payment tools such as MoneyGram, Western Union, etc will facilitate the transfer of funds from a credit card to a bank account. They do not charge a fee when transferring funds from a credit card to a bank account. But before using them, you need to consider the fund-bank account you want to transfer, the country in which it is located, the bank regulations, and the currency.

Transfer money from Credit Cards to Bank accounts using MoneyGram

By using Money Gram, money transfer from the credit card is easy. But it is helpful only if you want to send money to another country.

ie; you cannot send money from India to a bank account in India.

Follow the below steps to transfer money from a Credit card to a Bank account via MoneyGram

Step 1: Register or Login

Step 2: Select the Receiver or Add Receiver Country and details

Step 3: Select the’ Direct To Bank Account’ or ‘Account Deposit’ option.

Step 4: Select ‘Credit Card’ as the Payment option

Step 5: Enter Receiver Full name and Bank Account details

Step 6: Review and Transfer. Money will be deposited in the recipient’s bank account.

There are several other options to transfer funds from a Credit Card to a Bank account. But most of them will charge a fee for the transfer. So use them only when the fund transfer from a credit card is absolutely necessary.

Before using any of them, you should be very cautious and check the Fees and other regulations before initiating the transfer. Otherwise, the next credit card statement will have additional charges.

Join Our Facebook Group: www.facebook.com/groups/admeonline

Subscribe Our YouTube Channel: Youtube.com/admeonline

Also Read

- ICICI Bank Working Timing and Lunch Time

- ICICI Bank Balance Enquiry

- ICICI Credit Card application Status check

- How to get the Customer ID of HDFC Bank

- Full form of ICICI bank