Your SBI CIF number is the key to accessing all your banking details. This 11-digit unique identifier contains your complete financial profile with State Bank of India. Here’s everything you need to know:

📌 What is SBI CIF Number?

- 11-digit unique customer ID

- Digital record of all your SBI accounts

- Contains KYC, loan, and transaction history

- Required for most banking services

🚀 5 Ways to Find Your SBI CIF Number

1️⃣ Through SBI Net Banking (Fastest Method)

✅ Best for: Tech-savvy users

⏳ Time: 2 minutes

Step-by-Step:

-

-

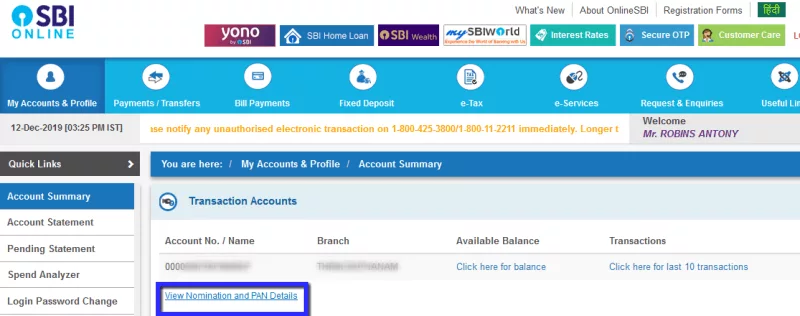

- Login to SBI Net Banking using your SBI Online User Name and Password.

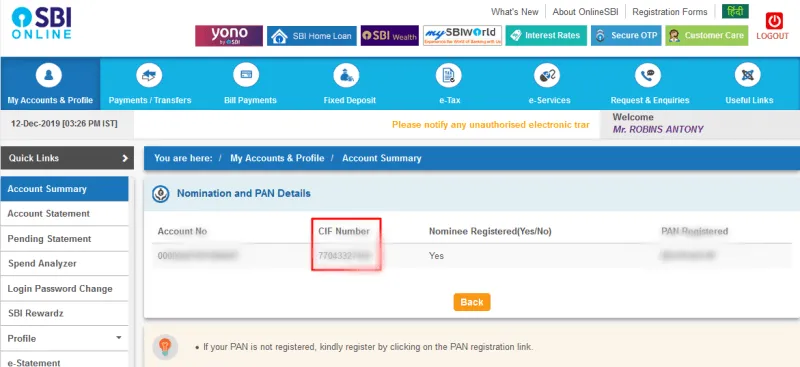

- Click on the Account Summary Menu on the left. There you can see your SBI Account Number, Branch etc ie; “Account Summary” → Select your account

- Choose “View Nomination and PAN Details”

- Your CIF number appears beside the account details

2️⃣ From Account Statement

✅ Best for: Those needing transaction records

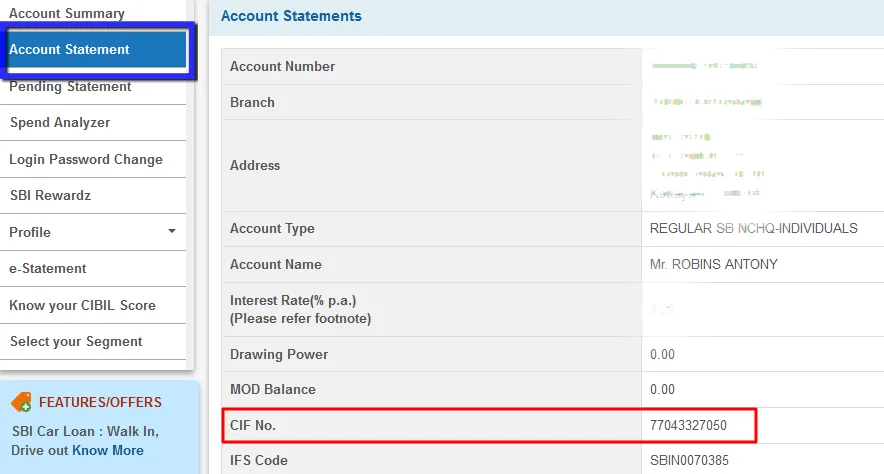

- Login to Net Banking

- Go to “Account Statement”

- Select any statement period

- Find the CIF number in the header section

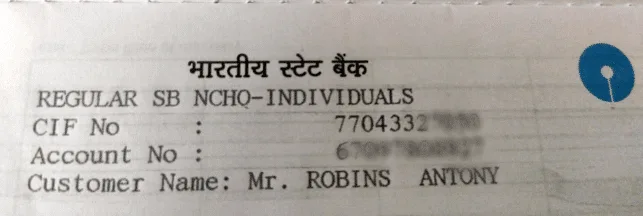

3️⃣ Check Your Passbook

✅ Best for: Offline banking users

🔍 Look at the first page of your passbook – CIF is printed near your account details.

-

4️⃣ Find in Cheque Book

✅ Best for: Quick physical verification

Your CIF number is printed on:

- First page of cheque book

- Below account number on cheques

5️⃣ Call SBI Customer Care

✅ Best for: Those without net banking

📞 Dial any SBI helpline:

- Toll-Free: 1800 425 3800

- Toll Number: 080-26599990

💡 Pro Tip: Keep your account details ready for verification

-

📱 How to Get an SBI CIF Number via WhatsApp Banking (Indirect Method)

While WhatsApp Banking doesn’t directly display your CIF number, you can use this smart workaround to access it through your e-statement. Here’s the complete guide:

🔄 Step 1: Register for SBI WhatsApp Banking

Option A: Via SMS

- From your registered mobile number, send SMS:

WAREG <Your Account Number>

to +917208933148

Option B: Via QR Code

- Scan the QR code from:

- SBI Internet Banking portal

- Official SBI website

- Send “Hi” to +919022690226 on WhatsApp

- Follow the chatbot instructions

🔄 Registration typically completes within 5 minutes

📥 Step 2: Request Your E-Statement

- Open WhatsApp chat with +919022690226

- Type “Hi” and send

- Select “Account Services” → “E-Statement”

- Choose a statement period (recommend 1 month)

- Verify with OTP when prompted

⏳ You’ll receive PDF statement within 2 hours

🔍 Step 3: Locate Your CIF Number

- Open the PDF e-statement

- Check the top header section

- Your 11-digit CIF number appears beside:

- Account number

- Branch details

- Customer name

📌 Pro Tip: Save the PDF for future reference as it contains all your account details

🆕 Alternative Method: Using YONO SBI App

For faster access, try this direct method:

- Login to YONO SBI app

- Tap “Profile” → “Account Details”

- Select your account

- View complete details including:

- CIF number

- Account type

- Branch information

✅ This method shows CIF instantly without waiting for statements

⚠️ Important Notes

- WhatsApp Banking available 24/7

- Only works with registered mobile number

- E-statements are password protected (use last 6 digits of debit card + DOA in DDMMYY format)

- For security, never share OTP or banking details with anyone

💡 Did You Know? Your CIF remains the same even if you open new accounts with SBI

🔗 More Useful SBI Resources

- How to Link Mobile Number with SBI Account

- SBI Net Banking Registration Guide

- Find SBI Branch IFSC Code

💬 Need Help? Join our Facebook Group for instant support!

📢 Pro Tip: Always keep your CIF number confidential to prevent fraud!

📌 Key Takeaways:

- CIF number is essential for all SBI banking services

- Easiest to find via Net Banking or passbook

- Never share your CIF with unknown callers

- Update your CIF details if any information changes

What is CIF Number in SBI?

The Customer Information File, or CIF, number of an SBI Account is one that is exclusive to each individual bank customer. This number maintains account details in digital format, including KYC details. It is a file that is kept in the computer system of the bank. All of a customer's information will be stored in a digital manner within their CIF number.

How can I find the CIF Number of SBI Bank?

The SBI CIF No, also known as the Customer Information File, is a one-of-a-kind 11-digit number that stores all of the vital information that pertains to that specific individual. You may look up the CIF number for SBI either online or offline. Customers of SBI have a number of options available to them for locating their Customer Identification Number (CIF), including using their online banking accounts (Net Banking), their account statements, their cheque books, their passbooks from State Bank of India Bank, and by contacting SBI Customer Care Service.

Where can I find the CIF number on my cheque?

In your checkbook, you will see your CIF Number printed for your reference. Chequebooks issued by some banks often include a space for the Customer Information File Number. It is usually located on the very first page of the chequebook.

How to find SBI CIF Number by SMS?

You cannot find the SBI CIF Number through SMS.Your Passbook, the YONO app, your Online Banking Statement, or SBI Internet Banking are all good places to look for the SBI CIF number.

👍 Found this helpful? Share with fellow SBI account holders!

🔔 Subscribe to Our YouTube Channel for video tutorials!

- Also Read SBI Related Posts: