Find SBI bank Minimum Balance Penalty Charges also learn how to check SBI’s Monthly Average Balance.

You can easily check the Monthly Average Balance (MAB) of your SBI Account Online. State Bank of India, India’s largest bank’s, recent changes made it easy for Internet Banking users to check their Average Monthly Balance online.

For Non-maintenance of Average Minimum Balance, SBI will deduct a penalty amount from its customer’s available Savings Bank Account Balance this penalty amount is different for different types of accounts, depending on the SBI account holders location like Metro, Urban, Semi-Urban, Rural etc.

You can find below the SBI Minimum Balance Fine (charges) for Savings Account and how is Monthly Average Balance (MAB) calculated in SBI.

To help the customers maintain the Minimum Monthly Balance, SBI added a new option in the Online SBI (Internet Banking) Account.

With this option, SBI customers can check the Average Balances of their savings account in the current and Previous Months.

Monthly Average Balance Check SBI

Follow below steps to check the Monthly Average Balance in SBI Accounts.

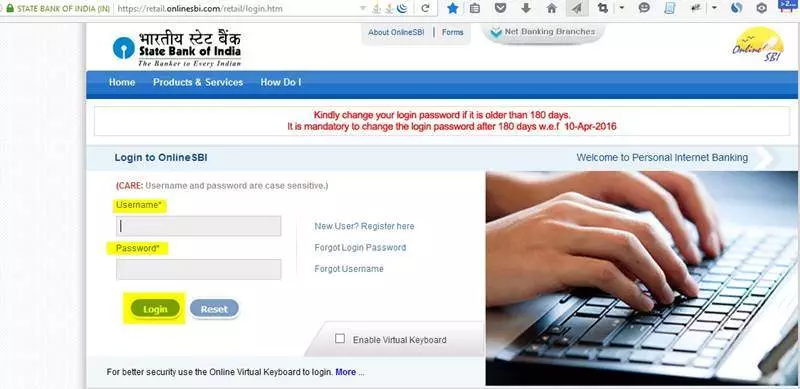

- Login www.onlinesbi.com using your SBI Internet Banking account User Name and Password.

- After the successful Login, you will be redirected to the SBI Account Summary page, where you can see the details of all your Accounts in the branch.

- Now click on the Link ‘Click here for last 10 Transactions‘.

- You will be redirected to a page, there you can see your Account summary details like the Account Number, Your Name, Available Balance, uncleared Balance MOD Balance, Monthly Average Balance etc

- Click on the link ‘Click Here For MAB‘ to check the Monthly Average Balance

- You can now see the average monthly balance you have maintained in the selected SBI account in the current month as well as the Previous Month.

By keeping an eye on your Average Monthly Balance of your SBI Accounts, you can avoid penalty auto deduction from the available balance by the SBI.

Note that this service is available between 8.00 AM and 8.00 PM.

SBI Minimum Balance Penalty Charges – SBI Monthly Average Balance Calculator

Find below the Penalty for Non-maintenance of AMB (Average Monthly Balance) – SBI Minimum Balance Charges for saving Accounts as on 11.03.2020.

-

- If the Average Monthly Balance Shortfall (Rs. 3000 – AMB ) of a SBI Account Holder in Metro and Urban Cities, is Less than or equal to 50% of the Required Average Monthly Balance

- (ie; <= Rs. 1500 ) then the SBI Minimum Balance Penalty Charges will be Rs. 10/- +GST

- If the Average Monthly Balance Shortfall (Rs. 3000 – AMB ) is Between 50% to 75% (ie; Rs.1500 to Rs.2250) (ie; Average Monthly Balance of a customer is between Rs.1500 and Rs.750 ) then the SBI monthly average balance charges will be Rs. 12/- +GST

- If the AMB Shortfall (Rs. 3000 – AMB ) is > 75% (ie; Rs.2250) (ie; Average Monthly Balance of a customer is < Rs.750, then the Penalty Amount will be Rs. Rs. 15/- +GST

Monthly Average Balance SBI Charges Summary for Metro and Urban Cities

[cs_table column_size=”1/1″ table_style=”modren”] [table “” not found /]

[/cs_table]

-

- If the Shortfall amount (Rs. 2000 – AMB ) of a SBI Account Holder in Semi Urban Cities, is Less than or equal to 50% of the Required Average Monthly Balance

(ie; <= Rs. 1000 ) then the SBI Minimum Balance Penalty Charges will be Rs. 7.50/- +GST

- If the Shortfall amount (Rs. 2000 – AMB ) of a SBI Account Holder in Semi Urban Cities, is Less than or equal to 50% of the Required Average Monthly Balance

- If the Average Monthly Balance Shortfall (Rs. 2000 – AMB ) is Between 50% to 75% (ie; Rs.1000 to Rs.1500) (ie; Average Monthly Balance of a customer is between Rs.1000 and Rs.500 ) then the SBI monthly average balance charges will be Rs. 10/- +GST

- If the AMB Shortfall (Rs. 3000 – AMB ) is > 75% (ie; Rs.1500) (ie; Average Monthly Balance of a customer is < Rs.500, then the Penalty Amount will be Rs. Rs. 12/- +GST

AMB (SBI Monthly Average Balance) Calculation Summary for Semi-Urban Cities

[cs_table column_size=”1/1″ table_style=”modren”] [table “” not found /]

[/cs_table]

-

- If the Shortfall amount (Rs. 1000 – AMB ) of a SBI Account Holder in Rural area, is Less than or equal to 50% of the Required Average Monthly Balance

(ie; <= Rs. 500 ) then the SBI Minimum Balance Penalty Charges will be Rs. 5/- +GST

- If the Shortfall amount (Rs. 1000 – AMB ) of a SBI Account Holder in Rural area, is Less than or equal to 50% of the Required Average Monthly Balance

- If the Average Monthly Balance Shortfall (Rs. 1000 – AMB ) is Between 50% to 75% (ie; Rs.500 to Rs.750) (ie; Average Monthly Balance of a customer is between Rs.500 and Rs.250 ) then the SBI monthly average balance charges will be Rs. 7.5/- +GST

- If the AMB Shortfall (Rs. 1000 – AMB ) is > 75% (ie; Rs.750) (ie; Average Monthly Balance of a customer is < Rs.250, then the Penalty Amount will be Rs. Rs. 10/- +GST

AMB (SBI Monthly Average Balance) Calculation Summary for Rural Area

[cs_spacer cs_spacer_height=”4″][cs_table column_size=”1/1″ table_style=”modren”] [table “” not found /]

[/cs_table]

If you have any questions, you can contact the SBI Customer Care.

Toll Free Numbers: 1800 11 2211 , 1800 425 3800, 080-26599990

If you need any help, chat with us or post your questions as comment below.

If you Like this Post, Please ‘Like’ and ‘Share’ it with your Friends.

Join Our Facebook Group: www.facebook.com/groups/admeonline

Also Read SBI Related Posts