Central Bank of India Balance check Number, Online, SMS, Missed Call Number

Last updated on August 30th, 2022 at 10:20 am

Central Bank of India provides several options for the Balance check. You can use the Central Bank of India Missed Call Balance Check Number, SMS Balance Checking, Online Banking, Mobile App, ATM, Passbook etc options for the easy balance checking of your Savings / Current Accounts in the Central Bank of India.

Central Bank of India balance Check Number - Missed Call Toll Free Number

An easy option for the central bank of India customers to check the account balance at any time by sending a missed call to the Balance Enquiry Number.

Save the Balance Enquiry Number 95552 44442 on your bank account registered Mobile Number as a contact, with the name Central Bank Balance Enquiry Number.

So you can easily dial this number and send a missed call when you want to check the balance of your account.

The call will be disconnected after few rings and you will get an SMS with the balance () on your registered Mobile Number.

Missed Call Balance checking facility is available to all customers including Savings Account, Current Account, Over Draft, Cash-Credit accounts, etc

Note: Your Mobile Number must be registered with the bank to use the Missed Call balance checking option. If your Mobile number is not registered with the bank then contact your home branch and submit the application.

You can also get the mini statement of the account by sending a missed call to 095551 44441 from your registered Mobile Number.

You will get the last 3 transactions on your account through SMS.

Central Bank of India SMS Banking - Balance check through SMS

Central Bank of India Customers can register their Mobile Number for the SMS banking facility by submitting the application form to the branch. You have to fill the application form with your Account Number and Mobile Number.

Once the SMS banking is activated, you will get a four-digit PIN within 5 working days, which can be used for balance checking.

Central bank of India Balance Checking SMS Format: SMS BALAVL <A/C No> <MPIN> to 99675-33228

When you send the SMS in the above format to 99675-33228, you will get the balance as SMS instantly.

Central Bank SMS banking facility provides several other options for the customers.

| SMS Banking Options |

Code | SMS Format |

| Balance Enquiry | BALAVL | BALAVL <A/c No> <MPIN> |

| Last 5 Transaction | LATRAN For default account.. | LATRAN <MPIN> |

| Last 5 Transaction | LATRAN For other account | LATRAN <A/c No> <MPIN> |

| Change Mobile Banking PIN | CHGPIN | CHGPIN <New MPIN> <Old MPIN> |

| Issued Cheque status Enquiry | CHQSTS For Default Account, | CHQSTS <Cheque No> <MPIN> |

| Issued Cheque status Enquiry | CHQSTS For other accounts, | CHQSTS <Cheque No> <A/c No> <MPIN> |

| Help on usage | Help | Help <MPIN> |

| Generate the MMID for IMPS | MMID | <MMID> to +919967533228 |

| Send the money through the IMPS | IMPS <Beneficiary Mobile No> <Beneficiary MMID> <Amount> <Mpin> | Example: IMPS 9988771234 987654 100 1234 |

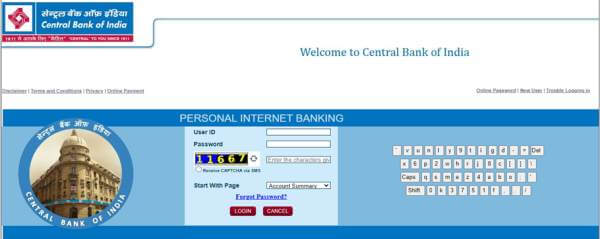

How to check balance in Central Bank of India Online

Bank of India provides an Internet banking facility to all its customers. So account holders with active internet banking account can check the balance at any time.

- Log on to the Internet Banking account with your net banking User ID and Password.

- After the successful login, you will be re-directed to the account summary page where you can see your account details including your balance.

Central Bank of India Balance check through Mobile Banking Application

Customers can download snd set up Central Bank Of India Mobile Apps from the Google Play Store and use that to check their account balance at any time.

Follow the below steps:

- Download the Cent Mobile App from Google Play Store or App Store and Install it on your registered Mobile Number handset

- Open the App and complete the New User Registration, If you don’t have an account in the App. For that enter your CIF Number and click on Submit button

- Now you will get an OTP on your registered Mobile Number

- Enter the OTP and submit

- After the successful validation, you can see two registration options

- 1. Using Internet Banking User ID and Password

- 2. Through the branch

- If you already have an Internet Banking account, You can enter your Internet Banking User ID and Password and then click on Submit.

- If you don’t have an active internet banking account, visit the nearest branch and request OTP for the Cent Mobile App.

- After the successful validation, you can set the MPIN (4 digit Login Password – required to login the Cent Mobile App ) and TPIN ( 8 to 10 character length alphanumeric Transaction Password) for the first time, if you don’t have the same

- Next time you can use these Login credentials and see the Account balance in the dashboard after the successful login.

Balance check through ATM

Central Bank of India provides ATM Cards to its customers which can be used to check the account balance on any ATM center in India.

- Visit any ATM and enter the ATM Card

- Input 4 digits ATM Card Pin

- Then select the ‘Check Account Balance‘ option

- You can see your account balance on the screen

How to check the Account Balance through UPI Apps

You can use the popular UPI Mobile Apps like Google Pay, Phone Pay, Paytm, etc to check the account balances at any time.

These Apps allow us to add more than one bank accounts in the app and can create separate UPI Pin for each account. Just select the balance check option in the UPI app and enter the UPI pin to check the balance of your account at any time.

Balance check through UPI app is very simple and straightforward as you don’t have to complete any other formalities to check the balance.

If none of the above options works for you, then you have to visit your home branch with your passbook and update it.

How can I check my account balance online in Central Bank of India?

You can use the Central bank of India Internet Banking and Mobile Apps to check the Account balance online. You can also use the UPI Mobile apps like Google Pay, Phone Pay, Paytm, Amazon Pay etc for the online balance checking.

How can I check my balance in Central Bank of India?

You can use the Central bank of India balance check Missed Call Toll Free Number: 95552 44442 for the balance checking. You can also send the SMS in the Format: SMS BALAVL to 99675-33228 to check the account balance at any time. Other options for the balance checking are Central bank of India Online Banking and Mobile App (Cent Mobile App)

How can I get CBI mini statement by SMS?

You can get the mini statement of the Central bank of India account by sending a missed call to 095551 44441 from your registered Mobile Number. You will get the last 3 transactions on your account through SMS.

How can I check my central bank account statement?

You can use the Mini statement missed call number 095551 44441 to get the mini statement as an SMS. You must send the missed call from your registered Mobile Number. To get the full account statement use the Cent Mobile App or login to the Central Bank of India Internet Banking Account.

Join Our Facebook Group : www.facebook.com/groups/admeonline

Subscribe Our YouTube Channel: Youtube.com/admeonline

Also Read Other Banks Balance Checking

Related Post

Resetting Your SBI YONO Login Password:...

Please ShareIf you’ve forgotten your SBI YONO login password, don’t worry! You can easily reset it using the following steps How...

SBI ATM Card Replacement Process: A...

Please ShareThe State Bank of India (SBI) is one of the largest banks in India, with over 24,000 branches and ATMs across the country. If yo...

Reporting Unauthorized Transactions in Your SBI...

Please ShareLast updated on November 17th, 2023 at 05:14 am In an age of digital transactions, safeguarding your financial assets is paramou...